MedTech industry trends will inform healthcare investing.

Venture Investors is one of the Midwest’s premier MedTech venture capital firms, investing in seed-to growth-stage MedTech ventures with a particular interest in university-licensed technologies. Scott Button, Managing Director of Venture Investors, spoke to mHUB about investing in MedTech. He discusses what industry trends will inform healthcare investing over the next 5 – 10 years as well as what MedTech venture capital looks like specifically in the Midwest.

In terms of MedTech venture capital, what kinds of technologies has Venture Investors been focused on, and how is that changing based on market trends?

Venture Investors (VI) has focused on investing in breakthrough technologies in the Midwest, with an emphasis on university-licensed technologies. We continue to see strong innovation in thematic areas where VI has had success, such as energy-based surgical tools, ophthalmology, and biopharma.

Aside from geographic trends, we remain highly interested in medical devices and believe regulatory changes like the Breakthrough Device Designation and MCIT coverage proposal will make these opportunities even more attractive. In addition, we have noticed a substantial increase in digital health startups in the region, a relatively new area of investing for us (VI has been around since the ’80s).

What are the biggest trends you predict in healthcare innovation and healthcare investing over the next 5-10 years?

- The ubiquitous nature of AI. It seems like a hot trend now, but we have only seen the tip of the iceberg. The quantity and quality of relevant information exceeds the capacity of the human brain to process. The data will be increasingly integrated. Diagnosis and treatment selection is a perfect problem set for the application of AI.

- Integration of AR and VR into radiology and surgery tools. These rapidly advancing technologies will be applied to data sets of 3-D and 4-D images, making them viewable in 3-D and 4-D or in a real-time overlay, improving the ability to locate and differentiate tissues and improve patient outcomes.

- The integration of wearables and telehealth. The quantity and quality of information from wearables will increase significantly and be available real-time, closing the gap between the value of the live and remote patient interaction.

- The transformation of the EHR. Will it be evolution or revolution? I am betting it to be triggered by the latter. The oligopoly and high switching costs is a barrier to change, but the physician burn-out from the soul crushing burden of loading data and the screen interference with the physician and patient face-to-face interaction is too big of an issue to go unresolved. Mandates for interoperability will put a crack in the dam and somebody will eventually blow it up. The impact will be too big to ignore, and the others will quickly scramble to follow. Automated device data capture, advances in voice recognition, and AI driven data synthesis to highlight patient specific data sets will result in a lot more love and a lot less hate in the love-hate relationship between the physician and the EHR.

- The relevance of the universe inside us. The importance of a healthy microbiome will be better understood and a more frequent pathway for treatment. The overuse of antibiotics and the downstream health effects will be identified, leading to microbiome restoration treatment following antibiotic use.

- Human organ transplantation will change. It has long been said that xenotransplantation is just around the corner…and will always be just around the corner. Now with CRISPR, it may just be around the corner. That is if we don’t figure out how to grow organs with human stem cells in 3-D printed scaffolds first.

What are some of the trends you are currently seeing, specifically in the Midwest, regarding healthcare innovation and healthcare investing?

There has been a lot of movement surrounding healthcare innovation and investment in the Midwest, specifically Minnesota and Chicago. In Minnesota, digital health as a whole is growing and funding within digital health has increased. There are strong industry commercialization efforts, but still a huge dearth of capital.

We are even more bullish on opportunities arising from universities. Increasing sophistication of tech transfer offices, increasing start-up activities at Midwestern universities, availability of university funds to de-risk technologies prior to VC financing, etc., are creating a robust pipeline of investment opportunities.

How do Midwest healthcare innovation and healthcare investing differ from the rest of the country?

From my perspective, there are a lot of concepts, both positive and negative, that make Midwest healthcare innovation and investing different than the rest of the United States. The Midwest has had a lot of successes and there are great opportunities for investing, but it’s still relatively hidden behind their Midwestern humility. That humility can go hand in hand with the fear of failure and risk tasking.

The innovation industry in the Midwest has a strong presence across the country, the quality of life is higher and startup costs are lower. We’ve been encouraged by growing support for venture funds and early-stage startups in the region.

What impact have you observed from COVID-19 on healthcare and medical device investing?

In general, we did notice that MedTech investing did suffer a bit and didn’t seem to accelerate the way that digital health and pharma did. Long term, we remain optimistic about device-based innovation.

With our portfolio, we are witnessing recovery and continuing strategic interest. For example, Elucent Medical returned to pre-COVID sales in November of 2020.

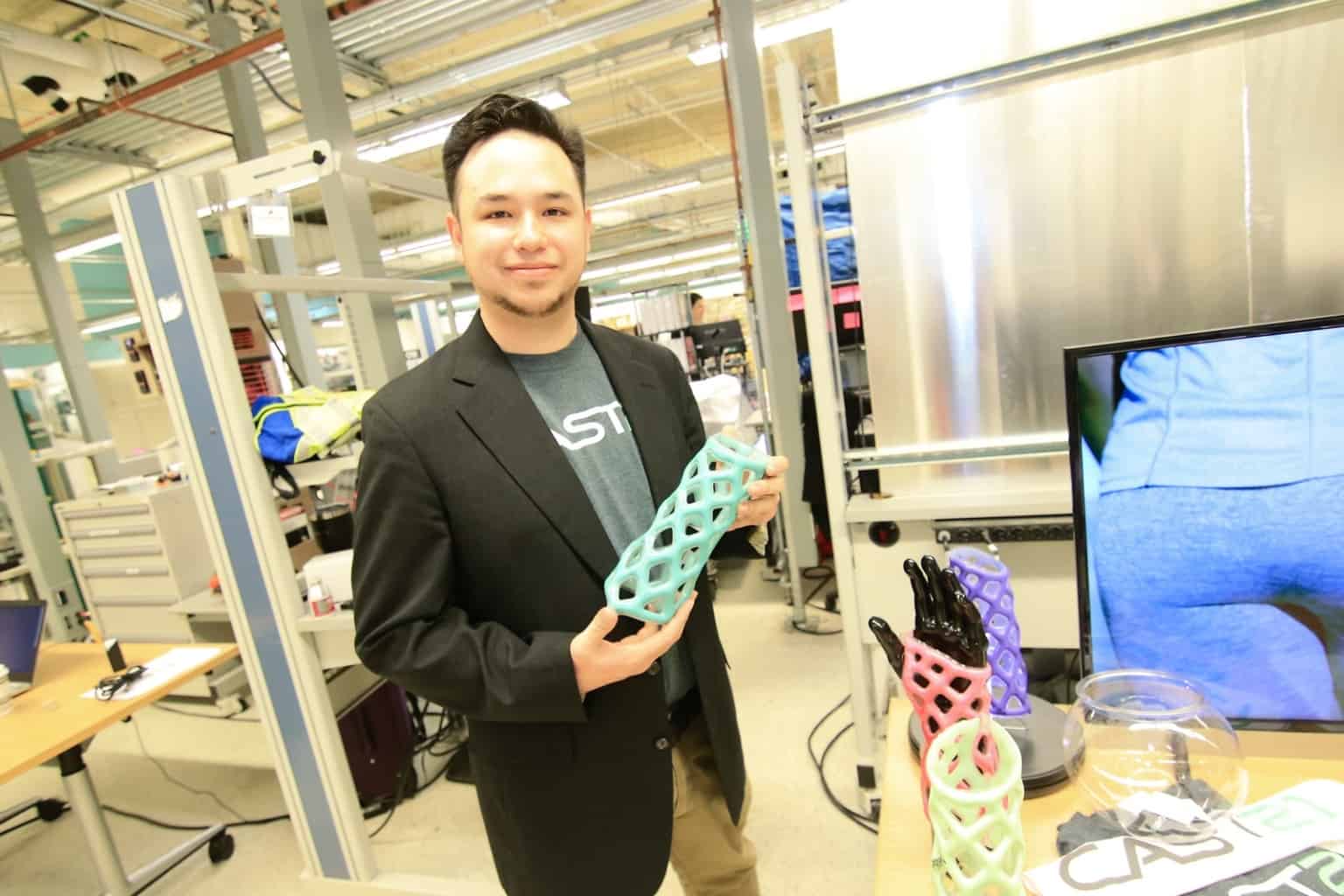

Applications are now closed for the MedTech cohort of the mHUB Accelerator. The program will commence in Chicago in Q4 2021. MedTech is the second vertical accelerator cohort of six that will launch over the next three and a half years and be supported by mHUB’s $15M Product Impact Fund I.

###

Learn how to become a corporate partner! If you are interested in being contacted about the next open application window for the mHUB Accelerator, complete the interest form below.