This conversation with guest speaker Robin Lanier, the Director of Renewable Gas at Southern Company Gas was part of the mHUB Energy Tech Accelerator curriculum for its 2022 cohort. Nicor Gas, one of the program’s industry partners, is one of four natural gas distribution companies of Southern Company Gas, a wholly owned subsidiary of Southern Company (NYSE: SO). This class was transcribed to share Southern Company Gas’ insights about the integration of renewable natural gas into energy systems.

Part I: Introduction to Renewable Gas

LANIER My team and I at Southern Company Gas work across all our local distribution companies in Georgia, Illinois, Tennessee, and Virginia. We function as a shared service and develop renewable gas strategy, programs, and projects—all in an effort to advance renewable fuels in our system and to help decarbonize the economy.

Today’s seminar focus is on Renewable Natural Gas (RNG), but it would be remiss if I did not mention this idea of an ecosystem as we think about the future of integrating new and lower carbon fuels across our system.

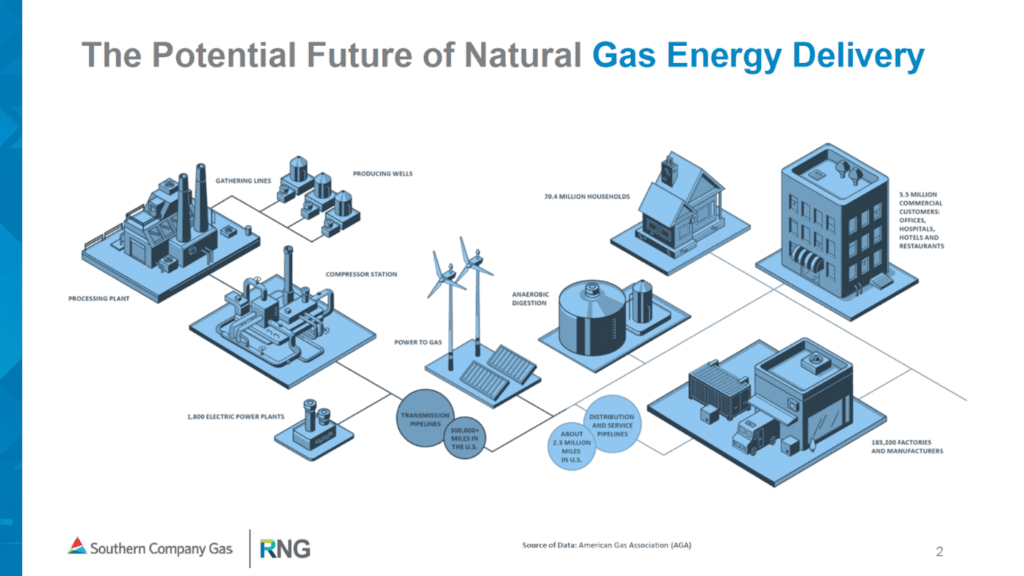

I’m sure you’re all familiar, but typical natural gas delivery is wellhead from an off-site location and delivered via transmission pipeline infrastructure. It then gets to a city gate, where local distribution companies (LDCs) distribute to homes and businesses. Southern Company Gas has a vision for the future: the integration of geologic natural gas and new, lower carbon fuels, a first and early example being RNG, into our system.

RNG can come from landfills, wastewater treatment facilities, power to gas and other technologies like energy crops. RNG facilities can be located behind the city gate on the LDC system and used as part of the public utility gas service. This benefits customers, communities and the environment.

As a business of local distribution companies, we see LDCs as being well positioned to serve as the hub of interchangeability between new and alternative supply line sources being integrated and delivered to customers. We have a vision that there is opportunity with our infrastructure to use new, lower carbon fuels, like how the electric sector has evolved from different generation sources. We see a similar opportunity for natural gas infrastructure as we move into the future of pipeline energy delivery and fuels.

Diving into that a little bit more, our sustainability organization exists to help advance our net zero goals while also supporting our customers’ goals. By marrying those two concepts together we land on a couple of different key focus areas.

One is the empowerment of emissions reductions economy-wide, or to enable energy efficiency and utilization of waste energy. We’re not only helping utilize our infrastructure but helping to decarbonize from an economy-wide view. We’re seeking to integrate a portfolio approach to decarbonization.

From an energy efficiency standpoint, this would mean more renewable fuels and continuing to tighten and harden our system to be even more efficient with the integration of renewable and lower carbon emission gas. Ultimately, our focus is to deliver clean, safe, reliable, and affordable energy to customers. Balancing those four things while moving into the future is something that we think about every day.

From seeking opportunities to integrate more sustainable sources of gas to continuing investment in our infrastructure, as well as supporting those economy-wide emission reductions and energy efficiency measures—those are all things I’m sure you’ve heard us talk about extensively. That’s what the sustainability team at Southern Company Gas focuses on. My area focuses on renewable gas, from both a hydrogen standpoint as well as RNG.

Part II: RNG Sources and Production Technologies

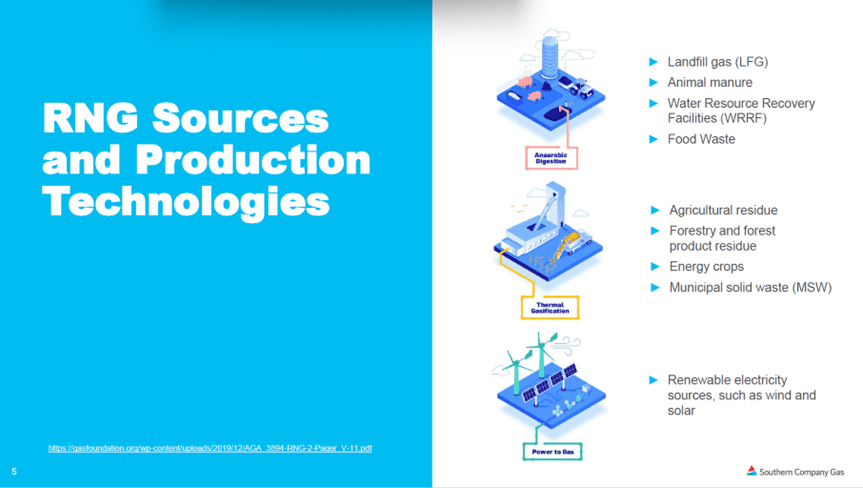

RNG currently is most commonly derived from organic waste decay, which emits several gases, one of them being methane. The idea behind a renewable gas facility is capturing and beneficially using that methane in a way to provide energy. That could be converting waste to electricity, or waste to gas. In a lot of cases, you can create hydrogen as an offshoot of that, or renewable natural gas, which can be a drop-in replacement for geologic natural gas.

Every dekatherm of RNG that we can capture and beneficially use is a dekatherm of geologic gas that is not needed. The RNG can then be transported into pipelines and delivered to customers. RNG can be used in all the same ways that geologic gas is used.

A little bit more on production technologies—we see a lot of technology types for RNG. Most used today is anaerobic digestion or landfill gas to RNG.

A technology that is still in its infancy but has the potential to move more into commercialization is thermal gasification. Thermal gasification is the use of energy crops to produce that offshoot of hydrogen, which is methanated and turned into RNG. You can pick up additional energy crops from thermal gasification, so we are interested in this technology and hoping to see its growth, especially because of its resource potential.

The third technology is power to gas. We use renewable electricity to power an electrolyzer and go through the electrolysis process to get hydrogen. Similar with the thermal gasification, you methanate it to make the natural gas replacement, or you can use it as hydrogen.

We do see a lot of use and benefits for hydrogen, specifically in industrial hub areas. So, pipeline, infrastructure storage and all of that is important for all these renewable fuels.

Environmental accounting, like wind and solar, is an important thing that we are thinking about at Southern Company Gas. Since RNG is virtually indistinguishable from geologic natural gas physically, we distinguish it by its environmental attributes. Under the WRI protocol as well as CDP reporting, there is the ability to report the value of RNG to reduce Scope 1 emissions through the application of renewable certificates, or renewable thermal certificates to gas consumption.

Now, that is more of a direct application of environmental benefits, like a solar renewable certificate, versus a carbon offset approach, where you would report both your consumption and your offsets, and then both of those combined could get you to net zero. RNG is a unique player in the national gas space because it provides an opportunity for reporting direct emission reductions through use of renewable fuels for consumption.

MEMBER Do you have an internal carbon price? And are there government regulations that affect you now regarding carbon emissions?

LANIER No, Southern Company Gas does not have an internal carbon price. There are scenario plannings that are done by our electric utilities. There are not currently government regulations that directly affect us as LDCs on carbon emissions pricing. We certainly go through the process as any other potential source to get permits, and we are subject to environmental reporting and compliance requirements.

MEMBER One more question about the RNG certificates, who issues those? You guys or the government?

LANIER Typically, the producer that is backed with verification from a third party.

Part III: Resource Potential

LANIER One common question that I get about RNG is, is there a limited number of resources? You only have so many landfills and wastewater treatment facilities. If you add it all up, what is the real potential for the national gas supply?

My answer to that is that it’s not an expectation that all geologic gas is going to be replaced with renewable natural gas.

That’s unlikely. But, if we are integrating that portfolio approach, if we are integrating energy efficiency, using alternative sources of energy and other items to reduce some of the throughput, it could wind up having a very meaningful impact on the displacement and reduction of the use of geologic gas.

A lot of these, as you’re doing life cycle and emission analysis, you can see that there is often more benefit to using these waste streams than just the displacement of geologic gas. Like in a dairy farm, for example, all that methane would just be going to the environment. By capturing and beneficially using it, there are typically methane destruction credits in addition to displacement of geologic natural gas.

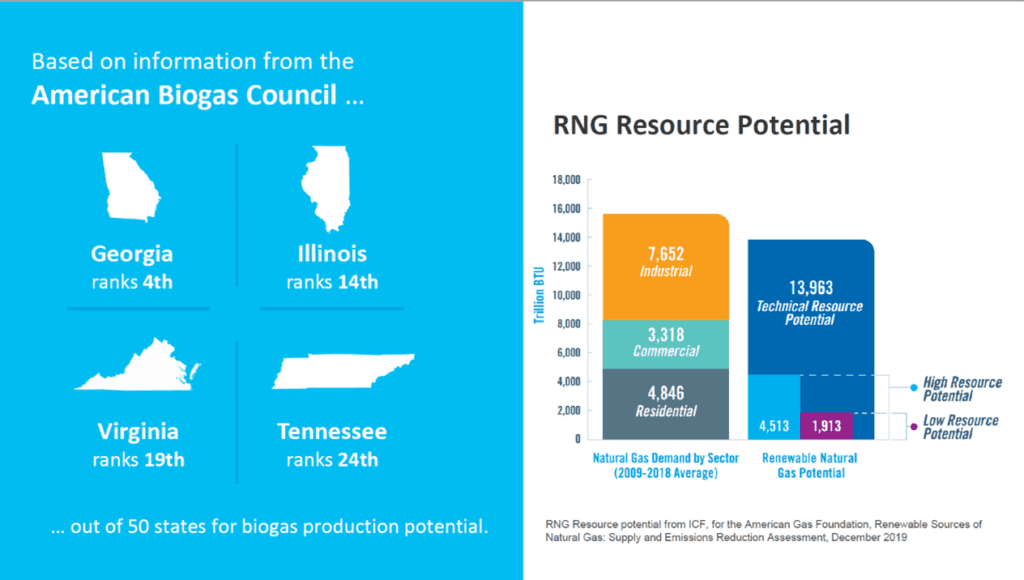

The potential around RNG, specifically for the environment and the displacement of geologic gas, is great. We are afforded tremendous potential, from a Southern Company Gas perspective, within the four states that we operate. Georgia ranks 4th, Illinois ranks 14th, Virginia is 19th, and Tennessee is 24th out of the 50 states for biogas production potential.

We’re better than average in terms of the potential to produce RNG. There was a study done by AGA and the national level summary reported that there was a lower resource, a higher resource, and then a technical resource potential scenario. We see tremendous opportunity, and this data indicates the potential for at least all the residential sector demand or equivalent being displaced by renewable natural gas by 2050.

As you integrate increased energy efficiency measures, the throughput volume would presumably decrease. As such, the percentage of RNG integration could be higher due over time.

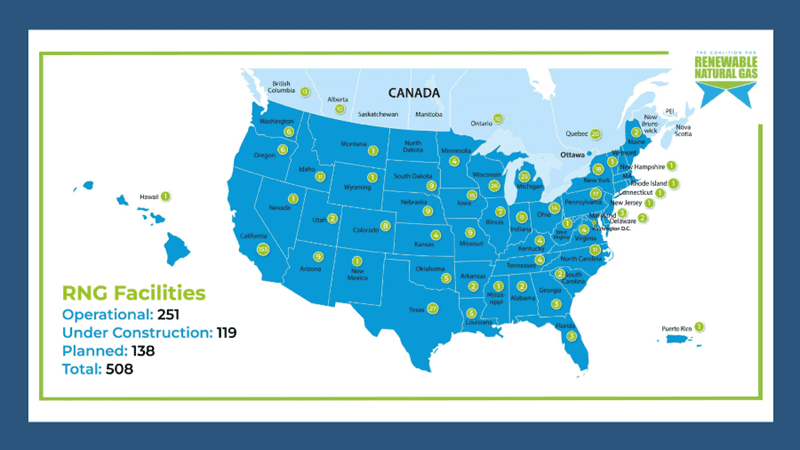

Here’s a snapshot from the Renewable Natural Gas Coalition that shows the RNG facilities that are either in operation, under construction or planned, for a total of 508 facilities across north America. You can see that there are 153 facilities in California either in operation or under construction, then three in Georgia.

I mentioned earlier that Georgia is number four in biogas production potential, but there is a disparity between the two states. One of the driving factors around that is some policy considerations. California has state level policies to grow the renewable gas industry. There are low carbon fuel standards and other items within the state of California that can drive more renewable natural gas production.

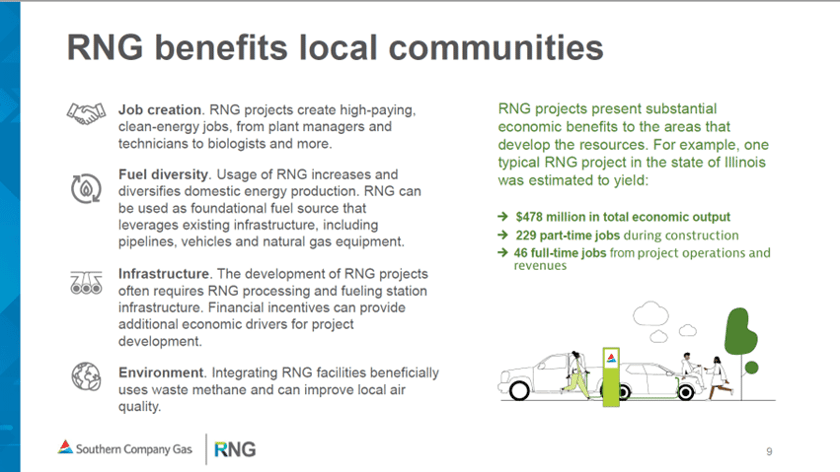

As we think about the benefits to our customers, our communities, and the environment, these projects, typically the anaerobic digestion, are worth $30 to $50 million or so in terms of investment, so they deliver on job creation, fueling diversity, energy security and providing additional infrastructure utilization.

We talked extensively about those environmental benefits. Looking at a particular project in Illinois, you can see it’s estimated to provide almost half a billion in total economic output. This is all done through implant modeling. 229 part-time jobs and 46 full-time jobs are just a representative illustration of one of these types of projects and the benefits that it can bring.

Part IV: Opportunities for Natural Gas Utilities

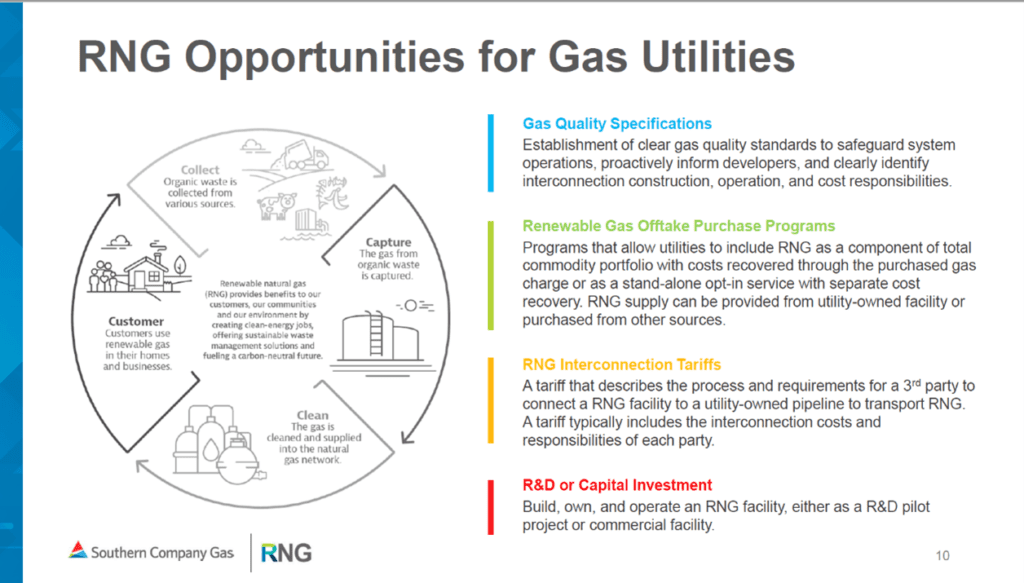

LANIER This last segment is around what the opportunities for natural gas utilities are, and specifically what Southern Company Gas is doing in that space to grow and realize the vision that I had talked about earlier. One thing is around gas quality specifications, and right now this is specific to renewable natural gas.

I mentioned that it can be a drop-in substitute for geologic natural gas, and that is true, but oftentimes RNG does have different constituents or different levels of constituents than what you may see in geologic gas. Also, since these facilities are located behind the city gate and our monitors tend to be at the city gate, we need to have more monitoring downstream to make sure that the gas that is being delivered to customers is of the quality that is safe and reliable.

We undertook an effort about a year and a half ago to develop comprehensive gas quality specifications. Obviously, we can’t plan for every single project type or circumstance, but we did take a very broad-brush approach and developed comprehensive gas quality specifications.

We provide those and producers can see what our expectations are for the renewable fuel. It provides a very clear and transparent expectation. It gives us assurances that we need for customers as to the delivery of safe and reliable energy. And it gives the developer guidance on what they need to do to be integrated into our system.

Another item is around renewable gas offtake purchase programs. This is typically done one of two ways: One option is a voluntary opt-in service, like what we have through the TotalGreen program in our Nicor Gas service territory. That’s where customers can opt in, pay a premium and receive RNG therm for therm, for every therm that they use.

Another option is where you could potentially integrate the RNG supply through the utility’s purchase gas adjustment mechanism, which is the PGA as local utilities call it. That would be supplied to all customers. We have a filing currently at Virginia Natural Gas requesting authorization for us to do that on more of a bulk basis. And you can sometimes gain economies of scale when you can do it that way.

There’s also the RNG interconnection tariff. Leveraging our facilities and allowing third parties to be able to interconnect—that goes hand in hand with our gas quality specifications. These interconnection programs are typically tariffs, which outline the rules of the road, so to speak, on what the process is and then how a third party can interconnect and operate on a natural gas utility system.

These tariffs are important because again, it provides that clear and transparent process on the steps that would need to be taken as well as the measures that would need to be managed for that continued interconnection.

And then finally, R&D and capital investment in facility. Southern Company Gas does own and operate a facility in Athens, Tennessee. It’s a landfill gas to RNG facility at Meadow Branch landfill, owned and operated under Southern Company for almost 10 years. We are also exploring opportunities for new projects as well as R&D opportunities.

There are opportunities even at Meadow Branch to use some of the landfill gas there and transform it to more usable sources of energy or at a new site to use it there. We continue to explore in ways to advance technology or demonstrate alternative uses of technology. We are very much in the space and evaluate a lot of projects.

Part V: Questions

MEMBER I was curious about how the production of RNG at Southern Company Gas is growing.

LANIER Growth across the country and in RNG has been doubling or tripling year over year—the curve is almost to the point that it looks exponential. There are a couple reasons for that. From a total capital cost perspective, it is typically cheaper to install a facility for landfill gas to power because you’re taking that raw biogas and just putting it in an engine. But the revenues that you can receive for the energy are just not as high in the power market.

It makes sense from our commercial standpoint for developers to go ahead and integrate biogas upgrading, to have that one additional piece of equipment and then be able to inject it in the pipeline. From a policy perspective, on the national level there’s a renewable fuel standard, as well as some other standard state level programs that incentivize the usage of renewable fuels in the transportation market. But then there’s also more and more corporate buyers that are willing to pay a premium on the RNG.

So, there’s a lot more market potential that we see today for the waste energy to fuel perspective versus prior to maybe five or six years ago.

MEMBER Can you give an idea of how much renewable gas there is as opposed to the total geological gas? If the total gas is hundred, how much of it is renewable versus the rest?

LANIER Right now it’s small. Today, you’re talking a low, single digit percentage.

MEMBER I see a lot of big corporations investing in renewable energy, like solar wind, to offset their own carbon emissions and to be better for the planet. Do you also see that happening, where corporations are investing in renewable gas?

LANIER Absolutely. Prior to my joining Southern Company Gas about two and a half years ago, I worked at Georgia Power. As part of my tenure there, I worked in renewable development on the electric side. At that time, around 2013, you started seeing more and more corporate buyers of renewable electricity. So, similar trajectory, right?

You had the utility players in the space buying it, maybe you had like a certain market or two, and that was early movers. Then you had the utilities, then you had the corporate buyers, then it became more widespread. I see the potential for a similar trajectory on RNG. There are certain specific markets today for transportation, and there are more utilities getting into the space.

Additionally, there are corporate buyers emerging. Utilities are getting there because their corporate buyers and customers want us to be there. It’s starting to become more widespread and mainstream.

MEMBER I had a question about one of your earlier slides in terms of the number of facilities you have across the country. Is that coming from a particular industry like dairy, or is that across all segments, like wastewater treatment plants and landfill waste.

LANIER That was all of them.

MEMBER You mentioned developers, do you do development of RNG facilities or are you just transport?

LANIER Southern Company Gas does explore opportunities to own and operate new ones. And we have been working with a few different developers in the space, as well as identifying some on our own. So, we’re trying to integrate within the market. We are looking for strategic investment opportunities, like how we did with Meadow Branch.

MEMBER What’s the biggest obstacle right now to the rapid deployment of these facilities?

LANIER I think demand is important. Customers demonstrating that they are interested in this type of product, from an environmental accounting perspective. There are educational opportunities for customers that are interested in this. There is currently a lot going on around the accounting for renewable natural gas which will all be very important over the near term in terms of making that expansion of RNG utilization.

MEMBER I have a question about your power to gas strategy, since the system becomes more complex, right? You have an electrolyzer, all the H₂ infrastructure, and now you are relying on your energy production facility. Is this a strategy where you could see partnering and collaborating with large owner operators?

Are you in the market carefully acquiring projects to co-locate or co-locating with the electrolyzer infrastructure? You are the Southern Company’s arm that is in the solar and wind generation space, so how do you go about that?

LANIER There are a lot of synergies across Southern Company in terms of the power to gas view. For us, understanding the chemistry, the different constituents I mentioned earlier. Solar and wind, it’s more of a synthetic, pure natural gas than something like landfill gas. We want to be in a place where we are understanding the technology, understanding the output, understanding the heat content, and all the things that go into delivery and consumption from a power to gas perspective. There are not a lot of commercial facilities for that technology.

So, learning more about that technology, helping to drive down costs, raising awareness—I think those things are near term. Longer term once they become more commercialized, trying to figure out if there is the right opportunity for us from an investment perspective with solar and wind resources, or if that’s something that instead we can unlock our system for to make sure that we’re ready to move it for somebody else that owns those other pieces upstream.

MEMBER Would that be driven by the end user before the discussion starts? We have a great perspective working with Southern Company, not only on solar and wind, but actually bringing this whole reliability of your energy supply chain into the operation of producing H₂.

This is because one of the problems we address is if solar and wind is not available, by making it more available and reliable as a resource, the industry such as your P2G arm could then actually predict more reliable operation and output when it’s needed. But do I put this on my roadmap now, or do I put this on the roadmap in five years? What’s the metric that triggers that interest?

LANIER I think it’s less about metrics and more about use cases. By us thinking about these things as a portfolio approach, it may make more sense to do power to gas, specifically power to methane in the near term. For example, in a circumstance where you do have that surplus of electric generation and you can produce hydrogen, but maybe you don’t have an end user right there or maybe today it doesn’t make sense to transport it to a certain customer, instead of that hydrogen just sitting there and that resource not being developed, maybe the use case is to methanate it and put it in the natural gas pipeline so that you’re immediately realizing it and using it today.

Maybe down the road you can use that similar infrastructure to use the hydrogen in a direct use. That’s how we think about the use cases, as a little bit more than just a metric. We believe that we need to invest from a wide portfolio of things because it will take all or most of them to get those economy-wide decarbonization opportunities.

MEMBER You mentioned that one of the obstacles or things you’re working on is education. What do you see as the biggest obstacle in that, or biggest misconception people have about RNG when you’re trying to get them on board?

LANIER One of the biggest challenges is the question of how is it produced? It’s a little bit more difficult to explain than something like solar or wind because of the chemistry behind it. It’s easier to point at a solar panel and explain the science of how it works, and easier for people to understand that it’s all about sunlight.

That’s somehow more intuitive than this process where you’ve got organic waste, you’ve got infrastructure to collect and hold the waste, and then you get gas on the output and so on. I think naturally people start to get a little inquisitive when you’re talking about waste from landfills or agriculture waste, they start to ask, well then what am I consuming?

And it spirals, so you wind up having more of a conversation about it. I think customers or whoever—the end user or interested party, stakeholders, regulators or even legislators—are often so busy that anything more than a ten second synopsis is too complex.

We need opportunities to show stakeholders how these facilities work, such as taking them to a facility, and that’s one of the reasons we own and operate the facility that we do. I can tell you all day long about it, but let me go show you and it’ll stick, so trying to create those opportunities, I believe will be invaluable.

MEMBER That kind of answers my second question of it’s an obstacle if people are grossed out by the waste aspect?

LANIER It can be, but it can also be a good story. Especially with landfills that are required to flare, us being able to use the gas instead of flaring it translates to a very good story. It changes the dialogue to be a discussion, and the more we can show, and there’s some great videos out there that consolidate that information into a few minutes, the more people are willing to listen.

Also, for a while there were a lot of companies and residential customers exploring ways that they may be able to electrify their homes or businesses and decrease their reliance on natural gas. But, just because of how valuable natural gas fuel is and a lot of industrial processes, it is often more expensive to do that. Even homes in more moderate climates like where I live, incrementally over time it was more money for me to make a switch to a total electric home.

As a conscious steward, I want to find ways that I can have renewable electricity, but then also find ways that I can have renewable natural gas options as well. I’m a program participant in a green option for natural gas service in my area. I think being able to provide customers with those opportunities, just like they have on the electric side is going to be important.

You see a lot of natural gas utilities marketers beginning to offer similar programs and you see some of the big oil companies starting to try to get into the space. I think there’s a big convergence around not being able to electrify certain things and keeping natural gas, so we are integrating renewable and more sustainable options. We’re definitely seeing that shift, we just need to catch onto that train, do the education and then be able to deliver.

MEMBER I think that’s a good conclusion of this session. I agree solar is great when we have sunshine, and wind is fine when the wind blows, but they’re intermittent and you cannot just go solo with one of those. But then long-duration energy storage comes into play, and then we have all these different ways to do it—gas, hydrogen, and so on. So, I’m happy also that part of this cohort is covering all of these different aspects.

To learn more about industry and corporate partnerships at mHUB, visit the Corporate Partner page.