2020 mHUB Investor Report: The Time is Now for Hardtech

Market behavior in previous crises favors sensible business growth and stability, which thrives in the Midwest. Hardtech sectors will lead the way

By: Manas Mehandru, Alex Lambert, Shannon McGhee, and Haven Allen

This annual report captures member fundraising progress and ambitions. Read about the growth within the mHUB member community and market trends.

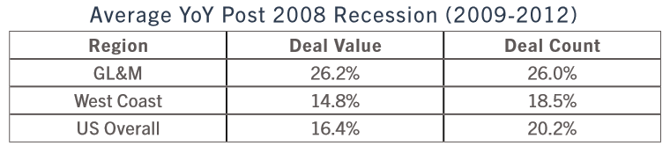

The current economic realities triggered by the global pandemic of 2020 are not similar in nature to those of either the dot-com bubble or 2008 recession. We can still look to the economy’s past reactions to forecast what is to come for the venture ecosystem now. In this time of crisis, the market will favor business sustainability over prospect potential.

Previous Economic Shocks and Investor Activity

Year over year for the past decade, venture investing continued to post record highs in dollars invested. In fact, before the COVID-19 pandemic, the U.S. saw a 62.4% growth, or $52 billion, in venture capital deal value over the past 5 years alone and analysts projected these high figures to continue. After seeing such tremendous growth, it is difficult to comprehend such a shift as the downturn marked by COVID-19. But looking at history, we have seen this dramatic plunge before. It ultimately shapes investor behavior and unlocks new opportunities in previously un-explored or under-valued companies.

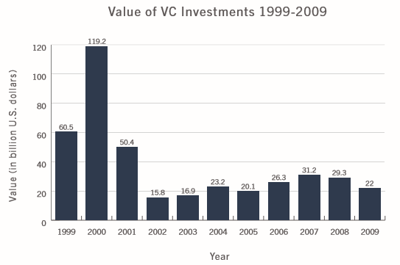

The notorious 2000 dot-com crash drove similar market behavior. The bubble excitement – fueled by a plethora of early-stage capital and interest surrounding growing internet companies – led to a record level of IPOs and influx of money due to the 1997 Asian financial crisis. This growth drastically changed the outlook for soft tech investors. In 1999, 39% of all venture investments went to internet companies, such as Amazon, eBay, pets.com, Napster, and Yahoo. The infusion of capital catapulted growth throughout the sector, as companies hit the public market at unprecedented pace.

Between 2000 and 2002, that bubble burst and the market experienced a staggering 76.81% fall. Investors watched the once multi-billion-dollar companies they invested in drop to zero.

As a direct result, investor behavior took a stark turn. The links between high valuations and prospect of growth were quickly rewired to favor company fundamentals. Qualities like a solid business model, a plan for cash flow, clear product development roadmaps and market potential became the strongest considerations in the diligence process. Companies with these characteristics – like Apple, Samsung, Tesla, NVIDIA, Qualcomm, and Peloton – began to lead in investments.

It was not until 2018 that U.S. venture capital funding reached in the volume seen in 2000, nearly 20 years after the bust of the dot-come bubble. But throughout the bumps in the economy, a new type of company gained attractiveness for investors: one built for sustainability, that leverages strong foundational business competencies.

History Repeats Itself: Today’s Global Pandemic and Investor Trends

Throughout 2019, economists were warning of an impending recession. After 10 straight years of a bull market and the S&P 500 up by 400%, this level was unsustainable. As expected, 2020 brought a hit to the economy, but differently than most economists and investors could have predicted. There was no clear market failure or bubble burst this time. Instead, there will be a $7.1 trillion dollar global GDP pothole that is exposing the fragility of the global economy. As in the past, things will recover. But this time, we expect there to be lessons learned, or more accurately re-learned, which will drive a different approach to investing: a pivot back to fundamentals. Some of the most promising startups have been built on years of consistent losses fueled by the promise of a lucrative exit (e.g. Uber, Lyft, WeWork, Peapod).

Typically, when markets dip, corporate debt increases and future earnings result in the fl ight of investors, particularly in volatile investments like startups. In past recessions, the market experienced significant reductions in IPOs and M&A activity for years afterwards. This leaves some investors either unsatisfied with highly leveraged, and now risky, corporate stock or impatient with subsidizing the growth of startups with a delay in exit of 4-6 years. The good news is that innovative technology is well-positioned to address foundational issues this crisis exposed across various industries. Investors are primed to be rewarded, but it will not be through unicorns as it has been in the past. Alexandre Lazarow has it right in his piece “The New Hot Startups Will Be Camels, Not Unicorns”: ‘Camels’, built to weather volatility but still deliver on the promise of high returns and cash-generating investments will be the next focus area for investors. The most promising sectors where these exist are at the nexus of hardtech and soft tech.

Smart Manufacturing and Industrial Internet of Things

(Expected 5yr Market Growth: 362%, $709B)

Before the COVID-19 crisis, the Industrial Internet of Things (IIoT) began showing signs of the next big opportunity. Grand View Research projected in 2019 compounded annual growth rate (CAGR) of nearly 30% from 2016 – 2025 reaching a market size of nearly $1 trillion. The challenges presented by the pandemic only strengthened the need for machine to machine communication, robotics, automation, equipment monitoring, edge computing, connected employees and other IIoT technology. The shortages of products across the country does not stop at Personal Protective Equipment (PPE). There has been a shortage of bikes, cameras, computer equipment, and countless other items. This is the case even while manufacturers have found ways to quickly return to their essential work. Other industries like finance, consulting, real estate, tech, and software have been able to shift to a work from home model without significant relative shifts in demand. Manufacturing, on the other hand, has experienced increased demand while having supply chain constraints and workforce limitations. Through this, it has become clear where the economic pain points exist. Manufacturers took a hit, not because of lack of work, but because of an inability to be nimble in an increasingly digital and remote economy. Manufacturers need to find ways to be more flexible to disruptions in global supply chains and nimbler to deliver quick solutions for local markets. IIoT innovation is positioned to deliver tremendous competitive value. It is no longer about efficiency in energy usage, lighting controls, and smart blinds/windows anymore. Manufacturers will need more; they need real business and market intelligence.

Other large opportunities reside in securing supply chain flexibility and enabling a nimbler workforce. Innovation around Cobots will have significant impact on the industry in the next 15 years. Performance management utilizing responsive artificial intelligence built on a foundation of hardware-based data collection solutions will position businesses to better analyze shifts in workforce fluctuations and supply chain constraints. New players will be created delivering IIoT platforms as a service. This will include integrations with Cobots, smart robots and existing equipment.

The promise of IIoT has never been more valuable or timely. Manufacturing is facing a convergence of three serious forces: an aging workforce, an increase in natural disasters and other supply chain disrupters, and the availability of smart and adaptable equipment. The growth of this technology will fortify the U.S. Manufacturing base that our economy, and our lives, depend on.

Med Tech

(Expected 5yr Market Growth: 248%, $312B)

Seemingly one of the most obvious areas to start looking to invest is within the healthcare sector. Currently, healthcare represents 12% of the U.S. workforce and 17% of its overall spending (10% globally). These numbers are expected to grow with increased health consciousness and an aging population. Recent projections have predicted CAGR greater than 19% over the next 5 years for Internet of Things (IoT) technology in the healthcare market. In the past decade, we have seen advancement in digital health highlighted by the recent $18.5B acquisition of Livongo, a hardtech enabled platform empowering people with chronic conditions to live better and healthier lives. COVID-19 is testing the foundations of the healthcare industry by affecting human and capital equipment resource availability. The shortage of PPE, ventilators, beds, and increased engagement from innovative problem solvers delivered quick solutions that were functional, but untested. This provided a unique window into the realities of the state of medical device innovation.

Medical technology has the highest barriers to entry compared to any other industry. Expensive tools and equipment are often needed to develop a product and there are necessary, and evolving, regulatory barriers. The COVID-19 pandemic briefly reduced the regulatory barriers and innovators quickly delivered disruptive ideas in a matter of days to solve some of the most pressing issues affecting our communities. This is lightning speed compared to typical industry product development cycles, which have historically been between 10 and 15 years. The fresh eyes of innovators across the country reduced the price of $30,000 devices to $1,000, and timelines for market entry were reduced to weeks. While many of respirators, ventilators and other devices pushed into the market were not fully tested, the number of solutions developed reveals the rich opportunity for improved designs and technological improvements. These new designs and improvements can be expected to be the drivers for sales going forward. Regulations will come back, but development timelines and the competitive landscape may fundamentally change. Regardless of what happens, it is reasonable to assume that if medical device companies do not collaborate with innovators now, they will have their cash cows slaughtered in a few years.

Smart Homes and Buildings

(Expected 5yr Market Growth: 247%, $21.8B)

The last recession was a clear hit to consumer markets, specifically housing. The COVID-19 crisis is exploiting weaknesses across all industries, consistently challenging internal collaborations and adaptability within business environments. The pandemic has catalyzed opportunity in the B2B space and in technologies that make hard assets more adaptable and improve remote controls and collaboration. Smarter equipment, buildings and collaboration tools will define this next decade of growth by delivering business resiliency. Successful investors will fi nd safe and solid returns through a combination of product sales and recurring revenue. Startups who can deliver B2B solutions that reduce disruptions in global workforce and supply chain will drive the next long bull market.

Connected Devices

(Expected 5yr Market Growth: 281%, $25.9B)

One of the more exciting, newer Camels is Peloton. Peloton is the largest global interactive fitness platform with a community of over 2.6M members. What makes Peloton so unique is that it has different product lines that diversify its revenue streams and cater to many different markets around the world. Between its multiple hardtech products, digital app, and apparel business, Peloton has a strong business model to weather the storms within the rapidly changing fitness industry. This model, along with its strategy surrounding COVID-19, has allowed the company to nearly quadruple in value since its IPO in September 2019.Hardtech will Lead in Returns Over the Coming Years

The economic recovery is widely expected to be quicker during this COVID-19 crisis, however the lasting impact of the additional debt it has brought will impact investors for years to come. Patience will be key, and with over $3T injected into the economy, Camels will win the race through this storm delivering solid returns and security. This new reality positions hardtech solutions as the most lucrative investments for the next decade.

In our current economic downturn and pause on record levels of venture financing, the question is: where will investors turn next? It is hard to foresee investors betting on startups promising big growth but operating at a loss for years to come. It will be the Camels who will dominate – those who are looking to create a reliable, profitable core before promising record growth. It is the Camels who will persevere through this financial drought and weather the journey far better that its peers.

In the coming years, innovation around the industrial internet of things, health tech and smart buildings will not only deliver economic resiliency but also significant returns for investors who support a wave of innovation that position products, people and businesses to adapt to the uncertainties that lie ahead.

At mHUB, we are focused on supporting hardtech and physical product companies – companies built on fundamentals. Through our various programs, mentors, equipment, corporate partners, and community of innovators, we strive to lower the barriers to commercializing product-based businesses.